Mandi of Organizing your way is sharing 31 Days of Organizing for a Better 2010 all month long. Today she is tackling the topic of debt, a subject that really gets my blood pumping. Seriously. She asked me to share a bit of my personal experience in that area and I gladly agreed!

My husband and I began our journey out of debt in the fall of 2007 and haven’t looked back since. Our finances had become unmanageable, and we knew that we had to make a major change. We paid off our final credit card in July of 2008. There were several key factors that contributed to reaching our goal so quickly.

- First we drastically cut our spending by adopting a frugal lifestyle and learning to use coupons effectively.

- We then amped up our income in order to apply Dave Ramsey’s principal of the “debt snowball“. My husband took a second job and I began working at a preschool part-time.

- We followed a detailed monthly plan for paying off each credit card, beginning with the smallest debt and finishing with the largest.

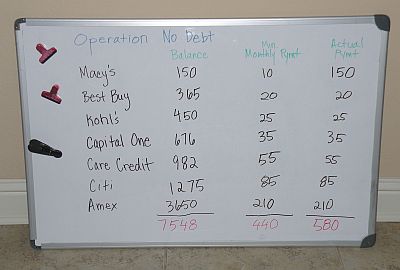

One tool that was extremely helpful in staying motivated was a visual of our debt reduction plan. Although we had a sophisticated excel spread sheet set up for us by a financial advisor, we also opted for simpler method- a white board.

This white board hung in a prominent spot in our home to serve as a constant reminder of our debt and our goal. We updated it every month to stay on track. It looked something like this:

*I pulled these numbers out of my head as an example

Average households in America actually carry an average of $8,000 in credit card debt. Gulp.

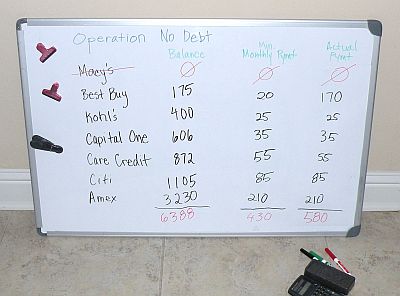

As you can see, we listed all of our credit card balances on the board from smallest to largest, along with the minimum monthly payment for each one. The farthest column on the right detailed the actual payment for the month. So the following month would look like this:

*I did not factor in interest

Rather than erasing the card we paid off, we put a big red line through it, with gusto! The psychological impact of this gesture was huge. We could see our progress, and it motivated us to continue our plan with fresh intensity each month.

*The total monthly payment stays the same each month

While this method is a bit unconventional, it was exactly what we needed. You see, the reason our credit card had gotten so out of hand, is because we were simply in denial. We avoided opening the mounting bills, and were unsure of exactly how much we owed.

By laying it all out in the open, there was no more hiding from our debt. It was staring us in the face and was not going anywhere unless we stuck with the plan.

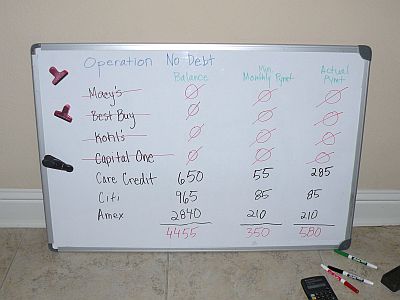

Eventually, the white board looks like this:

All those zero's feel great!

Each month, the actual payment stays the same, although everything else is changing. The balances start shrinking faster and faster, and the intensity picks up, hence the term “snowball”.

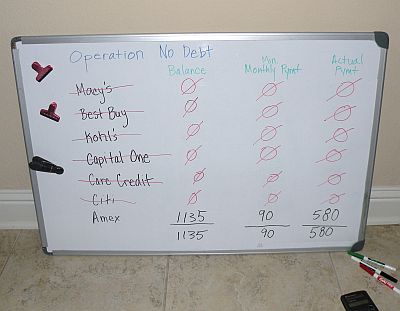

Only 1 card left!

All those red lines served as a reminder of how much we had accomplished. Because paying off debt is not about math. It is about behavior.

Another key factor in our journey was applying the principals found in God’s Word. We learned, for the first time, what the Bible says about money. Once we decided to start honoring God with our finances, getting out of debt became top priority.

My husband and I are not completely debt free. We have a mortgage, and student loans which we are currently paying down. Writing this post was a fantastic personal reminder for me about how effective that simple white board really was. On my to-do list this week is a freshly updated board with those scary numbers.

For more inspiration, read why FishMama wants to live debt free.

Be sure to visit Organizing Your Way, as Mandi shares her tips for paying off debt.

Bravo! What an encouraging post. I love the visuals.

We’re big Dave Ramsey fans in our house. In fact, we coordinate and just graduated our fifth FPU class at our church. It took us 2.5 years to pay off $32,000 debt (living on one income and with 6 months’ worth of two mortgages because of a move) but we’re so glad we stuck to it and are now debt-free!!! A marriage that is free from the chains of debt is one that is strong and unified in so many other aspects!! Thanks for the great post! I hope others are encouraged to free themselves from the slavery that debt creates and live a FREE life!!

Alyssa,

Hello I’ve been visiting and reading for a while now via EC. I really related to your 2010 plans ” scheduling computer time” and especially your reasons for that.

Couldn’t go past this post without commenting. It’s really timely for me. I had never heard of Dave Ramsey (here in Australia) but someone asked me about him and his “debt snowball” and ever since it seems I keep running across posts on blogs that are either supportive or critical.

Based on the “facts” and the math (and I’m not even a mathematically minded person) it seemed crazy to me that a finance guru of any kind was recommending this as a strategy.

However I see now for the first time why this is so effective for so many people (though the interest factor is often the whole point of the criticsm).

Those criticising however seem to forget that the people that this is effective for are those in debt and in need of a plan that works for them (perhaps because they don’t understand debt on a personal level?)

Anyway, very interesting and timely, also I have to say…

“You see, the reason our credit card had gotten so out of hand, is because we were simply in denial. We avoided opening the mounting bills, and were unsure of exactly how much we owed.”

I can so relate – I have a whole post on “not opening the credit card statements”, I was in denial and I really didn’t want to know what the damage was!

All the best for 2010,

Robyn

.-= Robyn @ Get Out of Credit Card Debt´s last blog ..Step 2. Track Your Spending =-.

I am also a huge proponet of using visual aids to help keep my mind on my money goals – I love to look at my chart and see the debt dropping and feel the level of control rising with each payment made! I actually carry mine around in my purse so that if I get an urge to stray from my budget, I can take it out and remind myself of what exactly I am working for.

.-= Keri´s last blog ..Menu Monday =-.

Love the visuals — very motivational!

.-= Tara @ Deal Seeking Mom´s last blog ..Target: $10.25 in New Grocery Coupons =-.

I love the visuals, Alyssa! You know I’m needing to catch up on my debt totals, so thanks for the motivation (you didn’t write this just for me, did you??? LOL!). Your tips are perfect and on-target. I love how you shared YOUR debt experience with us!

.-= Amy @ Amy Loves It!´s last blog ..Teach Your Child to Read in 100 Easy Lessons =-.

I love the visuals, Alyssa! It would be really motivating to see all the red zeros :-).

When we were paying off my student loan debt, I kept a spreadsheet so I could see exactly how many months I had left before they would be completely paid off…my motivation was to get them paid off so we could have kids (and so I could afford to stay home with them) :-).

.-= Corrie @ “Cents”able Momma´s last blog ..Qdoba: $5 Meal Deal With Online Order =-.

We have a similar board here at our house, except I used posterboard we already had because we didn’t have a whiteboard at the time. When the monthly amount or balance changed, I would just add a new sticky note with the new number. I loved it. I also stuck the actual credit card to the posterboard instead of writing out the name. That way, I couldn’t carry them around, and it was a very real reminder of how we got into this trouble in the first place.

We aren’t there yet … but we’re getting closer. Thanks for the post, Alyssa. Great job.

.-= Em.´s last blog ..Pantry Challenge: Week 3 =-.

God really does work in mysterious ways. Yesterday my husband was given Dave Ramsey’s book by a customer who was moving into house that he had paid cash for. Last night we read the first 9 chapters and today I came to see you and you are talking about it too. If I had any doubts in my mind they are gone. God Bless You and your family!

.-= Heather´s last blog ..General Mills High Value Coupon =-.

Heather-

I love this story! So glad you were led to the Dave Ramsey approach. While I know his methods do not work for every family, they have been incredibly helpful on our journey. Keep on reading that book! 🙂

I highly recommend the smallest to largest debt pay off strategy. While it doesn’t make financial sense it makes emotional sense and finance is 80% emotional or something close to that.

We paid off our debt the same way and have been debt free for over 2 years! We are never going back!

Toni

.-= The Happy Housewife´s last blog ..My Pajama Pants Addiction =-.

After following this plan I will be making the final payment on our credit cards next month, then comes the car. I need prayers to help me be brave and get this done because we have a lot left on it.

.-= Amanda´s last blog ..What’s coming up… =-.

THANK YOU SO MUCH!!!

By the time I got through reading this, I am in tears. We are in so much debt and our house in Texas will not sell, so we are paying 2 mortgages…well we were until Christmas came, and now we are behind. I was not sure until now how we were going to fix it. NOW I KNOW!!!! I am going to get me a white board, and do the same exact thing. We want to honor God in all we do too, and this mounting debt is not bringing honor to Him or to us. Thanks for showing me what I needed to hear!!!!

Misty-

Your comment gave me chills. I know how it feels to be in that position. Believe me when I say how much your life will change when you start making financial decisions to honor God. There is such a freedom when you are not drowning in debt!

Love that you are getting a white board. 🙂 It really does help!

WOW! I am so proud of you! Way to take charge!

.-= Jeanne @ Inspiring Ideas´s last blog ..Tutorial: Glossy Bookmark or Magnet Gift =-.

I love this idea. I keep track in a calendar but having a visual to look at that is that big and bold will really get a point across. Great idea. Too bad I donated our big white board to good will when we moved into the new house. A large piece of children’s drawing paper will work though.

We are drowning in over 22,000 in credit card debt. I don’t know how and when it got so out of control. It wasn’t that long ago that I would hear the commercials on TV that would say, “Do you have more than $10,000 in credit card debt?” and I would smile and say nope. Now…I don’t even know where to start. We were just turned down for a loan to consolidate our debt. We can reapply when our income is higher or our debts are lower…what???? why would I even need the loan then…thanks for nothing! I guess I get to go look for another job. Ugh!

Love the whiteboard idea – my husband thought of that too. He’s big on visuals, and when I start spouting spreadsheet stuff to him, he gets glassy-eyed and unresponsive, and I can tell he needs an EMT (eyeball-method translation). SOOOO…we have an unused whiteboard that we’re going to make into a life-sized spreadsheet. We plan to put Geo Tape on it and make columns so we can see exactly what we’re up against (yeah, my idea…can’t get away from the spreadsheet thing – happens to all who work in accounting!).

@Linda, Linda, it’s been a few months since your comment, but how is the technique working for you? 🙂 Any progress on your debt?

@Alyssa Francis, OH yeah! We just started our third month of budgeting, and we’re staying ahead of the game so far. The board is doing very well. Steve uses it to keep up on our progress. I still do the *yes* spreadsheet 🙂 on the computer also. Right now we only owe on the house, and are still gradually building back the money we spent paying the car off, AND putting some aside for trips, fun, etc. Thank you for your encouragement!!!

I love the visual board that is great. We are great fans of Dave Ramsey and are working at paying off our debt. We have not used credit cards for over a year and will never go back.

May not be able to fly off to Vegas for New Years but no credit card company owns our soul.

I love seeing young people wanting to be credit free which I had done it 20 years ago.

Keep spreading the word.

I love the visual that you are using. Keeps it up front. We gave up credit cards over a year ago and will never go back. I love seeing young people wanting to be debt free. I wish we had done it 20 years ago. Keep spreading the word.

I love that you posted this. My husband have big into Dave Ramsey for 11 months and have paid off $21,006.92 of our total debt (on annual income of $38,000/yr). We check out the books and cd’s from the library, download the podcasts on line for free and I have found a really cool spreadsheet on Google Docs that simulates the snowball spreadsheet that you have to pay for on the Dave Ramsey site. It is called Cardan Avalanche. (I think snowball might be copyrighted.) It is so nice because you enter what debts you have and what you are paying and it gives you a payoff date. Tinker with the totals and it changes the date. I love watching the months fall off when I can throw extra. Also on the payments tab,you can draw a line through each payment as you make it and turn the month red. What satisfaction!

Here is the link if you are interested.

http://tinyurl.com/ylyzt8f